3. (a) Explain what might happen to the level of inflation if a government decides to move from a budget surplus to a budget deficit. [10 marks]

Inflation happens when there's a sustained increase in the average price levels. As in macroeconomics one of governments' main objective is low and steady rate of inflation, they are often ones trying to manipulate it. Government can target inflation through spending, as government spending is part of Aggregate demand which determines inflation. AD= C+G+I+(X-M)

As government moves from budget surplus; meaning they receive more tax revenue than they spend in a year. To a budget deficit; a government spending more than it earned as a tax revenue over a year. It likely means they have increased the governmental spending in the economy, which means an increase in AD and is therefore likely to increase the rate of inflation.

Another way a government could go from a budget surplus to budget deficit, yet still cause a rise in the rate of inflation is by decreasing taxes. A decrease in taxes would mean less government revenue yet it would encourage more spending in the population, therefore increasing AD.

*I'm sorry for borrowing this one from on-line

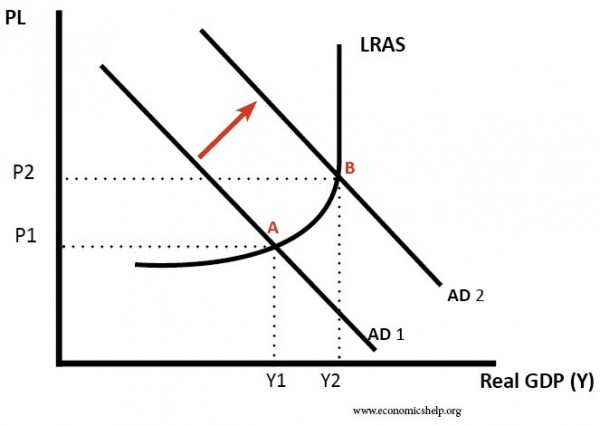

Through these expansionary fiscal policy methods, governments would increase AD, causing the AD curve to shift to the right. Resulting in a new equilibrium B, at which the average price levels have increased from P1 to P2 and the Real GDP has increased from Y1 to Y2. This would only happen if we were to assume cetris paribus for the other determinants of AD and that there has been no outwards shift in the LRAS. As there is no increase in supply in the long run, it could possibly be a demand-pull inflation as the economy isn't able to meet the demand and would be forced to increase prices. Therefore if through government spending or decrease in income tax as an example of expansionary fiscal policy, the AD shifts outwards resulting in higher average prices there has been an increase in the rate of inflation.

In real world this might not always end up in the best way as high inflation might cause more inflation as people will be looking for cheaper goods to buy and the countries own goods would not be competitive enough on the world market, therefore increasing imports and decreasing exports. This could lead to trade deficit, in return causing a further decrease in the governments budget. This situation is known as the twin deficit hypothesis. This is a situation United States has been battling for many many years already.

(b) To what extent is an increase in interest rates the most effective cure for inflation? [15 marks]

As mentioned above, inflation is often combated through governments activities such as fiscal, but also by central banks activities. Interest rates, the cost of a loan expressed as a percentage, is part of monetary policy. Monetary policy includes the Central Bank managing interest and exchange rates to control the quantity of currency in the economy.

As the central bank rises interest rates, it will lower borrowing and encourage saving instead as consumers are likely to benefit more from saving due to higher interest rates. Less borrowing and more saving means less spending in the economy, eventually meaning less consumption. As mentioned above C is a part of AD, therefore a decrease in C would mean a decrease in AD. Vice versa to the explaining in part a, when AD lowers, the APL and real GDP are likely to fall.

As there is a shift to the left from AD1 to AD2, the APL drops from P1 to P2, but there is also a drop for real GDP from Y1 to Y2. From this graph we can also see how using interest rates would only work in the short run. In the long run the suppliers would adjust back to the more efficient level.

As there is a shift to the left from AD1 to AD2, the APL drops from P1 to P2, but there is also a drop for real GDP from Y1 to Y2. From this graph we can also see how using interest rates would only work in the short run. In the long run the suppliers would adjust back to the more efficient level.Yet using interest rates too vigorously and for too long to combat inflation rates may hinder economic growth. As shown in the graph the real GDP values drop together with inflation as there is less consumption. Less consumption is essentially less demand in an economy, so in the long run businesses will want to opt for the new level of demand and will decrease their production. Decreasing production in return means letting workers go, therefore increasing the level of unemployment in the economy. high levels of unemployment in return means even less consumption, furthering the drop in inflation. Eventually the drop could get too big and start to harm the economy instead. For businesses, higher interest rates also mean less investment therefore hindering businesses from evolving in terms of size and efficiency.

Additionally, higher interest rates may encourage foreign portfolio investments, therefore causing an appreciation in the currency. Higher exchange rate in return makes it harder to export and better to import, resulting in trade deficit; high imports might eventually worsen the inflation again.

Therefore we can conclude that interest rates are a good and efficient way to effectively combat high inflation quickly and for a short amount of time. Yet even then it depends whether inflation is a result of an appreciated currency or high AD. Yet if there's a need to control inflation in the long term, the most effective ways include supply side policies such as subsidies and tax breaks for producers to increase the long run supply to meet the rising demand and therefore combat rising price levels and still maintain economic growth.